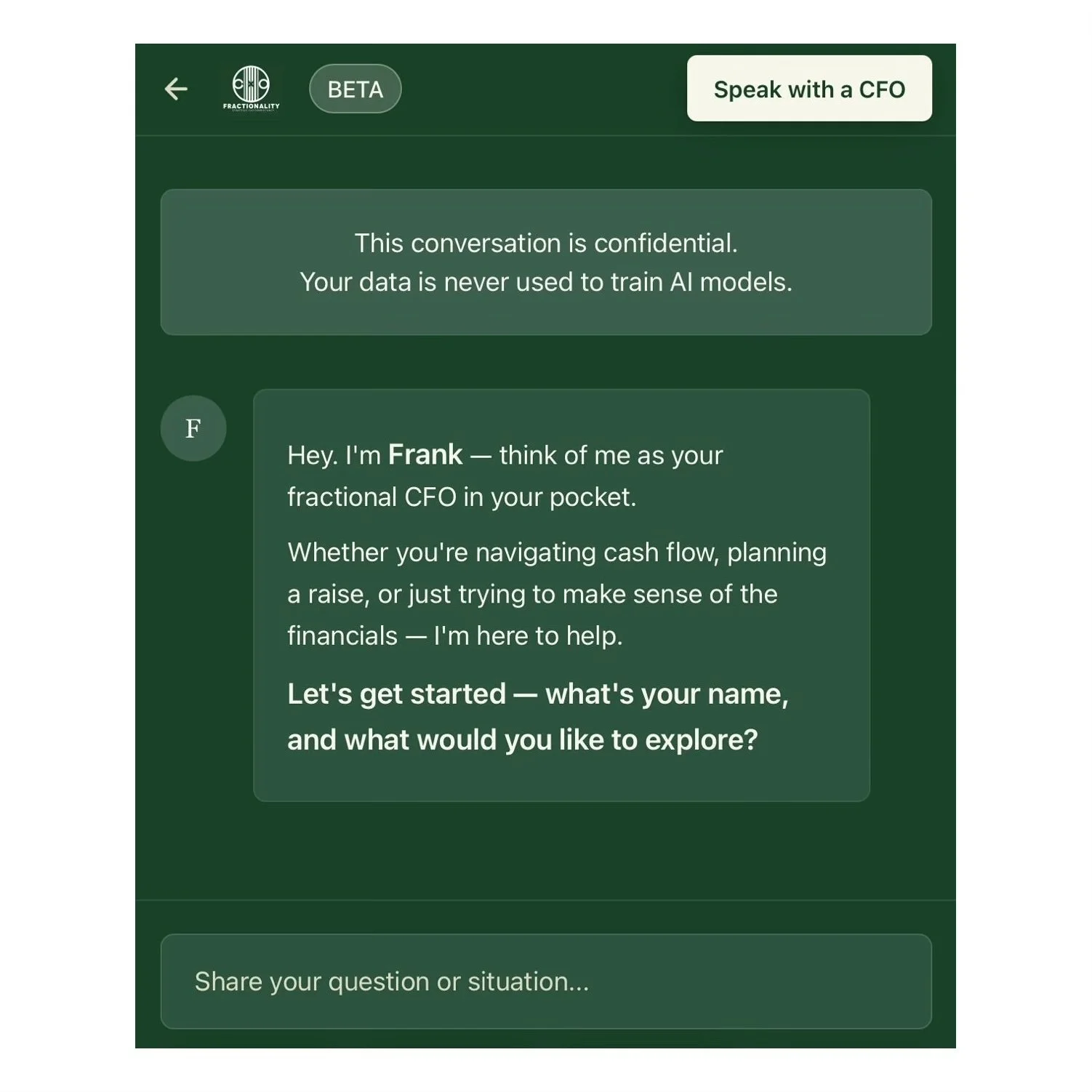

We Interviewed Frank, about Frank.

Frank has been developed in-house as a bespoke AI-powered Fractional CFO, trained and shaped by real CFOs from Fractionality (free to use during beta).

Conversations with Frank are confidential, focused, UK-centric and available 24/7.

We thought it'd be interesting to Ask Frank about… Frank.

Meet Frank: An AI-powered CFO, shaped by Fractionality CFOs

Frank has been developed in-house as a bespoke AI-powered Fractional CFO, trained and shaped by real CFOs from Fractionality — and completely free to use during beta.

Confidential, focused, UK-centric and available 24/7, Frank exists to help founders and business leaders think clearly about cash, growth, and enterprise value at a strategic level.

He isn't a replacement for human judgement, but he will help you reason through the moments that matter.

The Human Side of AI | Part 1: Spinning or Hiding. The Two AI Reactions We See Everywhere.

The most honest question about AI right now is not technical.

It is human.

Is your head spinning, or is it in the sand?

Almost every leadership team we speak to falls into one of these two camps. Sometimes both, depending on the week. Neither is a strategy. Both feel understandable. Both quietly cost you ground.

Growth, Actually | Chapter 3: Paperwork That Pays

Growth, Actually is a series for founders who want to build something real. Not just raise, not just run fast, but build well. The kind of growth that doesn't leave you burnt out, diluted, or wondering what exactly you just built.

Founders love to talk about growth as if it’s all about momentum. Big energy, bigger charts, the story you tell on stage. Then the year ends and the tax bill arrives quietly, like an uninvited editor, and rewrites the story you thought you were living.

Tax is not just compliance.

Growth, Actually | Chapter 2: The Human Balance Sheet

Growth, Actually is a series for founders who want to build something real. Not just raise, not just run fast, but build well. The kind of growth that doesn't leave you burnt out, diluted, or wondering what exactly you just built.

This chapter looks at the quiet thing that can still undo all of that. People. Not because people are unreliable, but because growing companies concentrate knowledge, access and decision making in too few heads. Numbers sit still. People do not. When plans meet real life, it is the human weak points that bend first.

Growth, Actually | Chapter 1: Profit Isn’t a Dirty Word

Growth, Actually is a series for founders who want to build something real. Not just raise, not just run fast, but build well. The kind of growth that doesn't leave you burnt out, diluted, or wondering what exactly you just built.

In each chapter, we’re digging into the parts of scaling that get left out of the highlight reel. First up: profit. Boring? Maybe. But also the difference between lasting and lasting just long enough.

Fundraising Fundamentals | Chapter 3: Narrative Engineering

This is the final part of our three-part series on funding readiness.

In Chapter 1, we looked at the hidden due diligence that starts long before anyone asks for a data room. In Chapter 2, we dissected the numbers behind real growth.

Now we turn to something a little more delicate; the narrative. Not the slides. Not the slick lines. But the real story you are telling about your business, whether you mean to or not.

Fundraising Fundamentals | Chapter 2: Counting What Counts

Last time, we made the case for treating due diligence as the quiet foundation of every successful raise, not a panic exercise.

Now we turn to your numbers, but not the ones you trot out on pitch day to impress a room. We mean the numbers that show whether your business is actually working, whether your growth is real, and whether you will survive.

Fundraising Fundamentals | Chapter 1: The Silent Audit You’re Already Under

This is part one of our three part series on funding readiness.

In this installment we show how weaving due diligence into your routine builds the quiet confidence investors seek.

We are also pleased to share that we are moving forward with our new partner, Diligentsia, whose expertise in legal and governance due diligence will complement Fractionality’s financial leadership.

Scale Smarter: Which CFO Model, Interim, Part-Time, or Fractional, Fits Your Needs?

Choosing your CFO support is like deciding between a quick oil change, a full engine tune-up, or a comprehensive diagnostic and rebuild.

You need the right level of service to keep your business engine humming.

The Problem: Mismatched Financial Leadership Models That Stall Growth

The Price Is Right: How to Build a Pricing Strategy That Maximizes Profit

Setting the right price is one of the most important financial decisions you’ll make.

Price too low and leave money on the table; price too high and risk losing customers.

Use the wrong model and scaling becomes harder.

Great pricing isn’t just about covering costs—it’s about maximizing value and driving long-term profitability.

Surviving Economic Downturns: How to Build a More Resilient Business

Economic downturns happen. Whether it’s a market crash, interest rate hikes, or a global crisis, the businesses that plan ahead survive—and the ones that don’t? They get caught in the storm.

When things get tough, cash is king, debt becomes a burden, and agility separates winners from losers.

Debt vs. Equity: What’s the Best Way to Fund Your Business?

You need capital. Do you borrow it (debt) or give up shares (equity)?

Each option has massive consequences for your business. Get it wrong, and you could:

Lose control of your company by giving up too much equity.

Get buried in debt with monthly repayments draining your cash flow.

Tariff Trouble? What UK Exporters Need to Know About the Latest U.S. Trade Move

As of this month, the U.S. has imposed a 10% tariff on all UK imports, with 25% duties on vehicles and other manufacturing-heavy categories. Not just a headline—an actual line item on your margin.

Whether you’re exporting whisky, wellness products, electric bike parts or anything in between… this is going to sting.

But it doesn’t have to derail your business.

Growth vs. Profitability: Striking the Right Balance for Long-Term Success

Every founder faces this million-pound question at some point:

Should we push for aggressive growth?

Or should we focus on profitability first?

The answer? It depends—but getting it wrong can be a costly mistake.

Is It Time to Sell? How to Know When Your Business Is Ready for an Exit

Selling your business should feel like a celebration of everything you’ve built—not a last-minute scramble to fix financials, chase down contracts, and realize you left millions on the table.

Yet, too many founders wait until they’re burned out before they start thinking about an exit. Big mistake.

Raising Capital? The Key Financial Red Flags That Scare Off Investors

You’re pitching to investors. Your deck looks great. Your story is solid. But when it comes to the numbers, the conversation suddenly feels… uncomfortable.

A Fractional CFO helps you prepare for funding rounds like a pro. Here’s how.

Scaling But Struggling? Why Cash Flow Kills Growing Businesses (And How to Fix It)

Growth is exciting. New clients, bigger deals, more staff—it’s everything you wanted, right?

Except… the bank balance tells a different story. More revenue should mean more cash, but somehow, you’re constantly scraping by.

You’re not alone.

How Valuable Is Your Revenue? Changing Your Model to Recurring Revenue Can Boost Your Business’s Worth 🚀

So, you’re making good money. Sales are strong. Customers seem happy. But every month, you’re back at square one, hustling for new deals just to keep revenue flowing.

Sound familiar?

Thinking About Staff Incentives? How an EMI Share Option Scheme Can Help Grow Your Business Value (😀 + 📈 = 🔥)

Every founder gets there at some point: You’ve got great people, but you’re struggling to keep them.

Maybe your competitors are poaching your best employees. Maybe you can’t afford to hand out massive pay rises. Maybe you’re worried that without real skin in the game, your top team won’t stick around long-term.